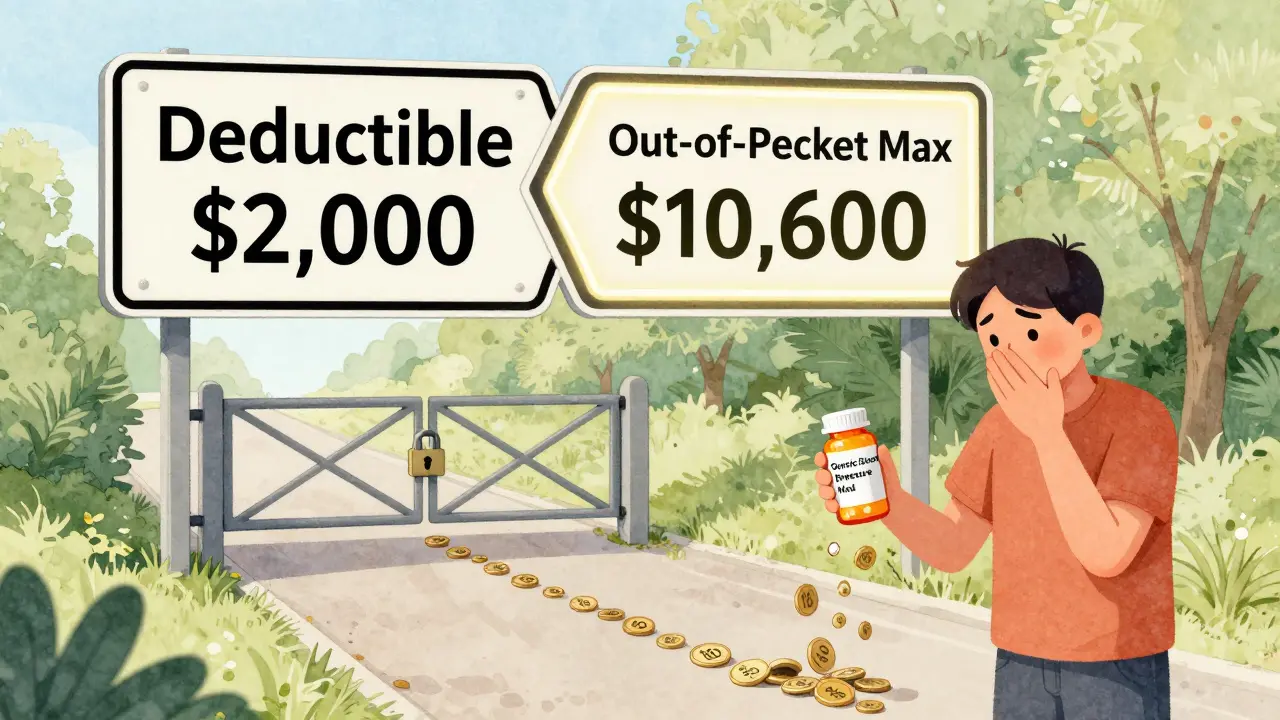

Let’s say you take a generic blood pressure pill every day. It costs $10 at the pharmacy. You pay it every month. After a year, you’ve spent $120. You think, ‘I’ve paid $120 toward my deductible. I’m getting closer.’ But here’s the catch: that $120 doesn’t touch your deductible. It does count toward your out-of-pocket maximum. And that’s where most people get tripped up.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay for covered services before your insurance starts sharing the cost. For example, if your deductible is $2,000, you pay the first $2,000 of doctor visits, lab tests, or hospital stays yourself. After that, your plan kicks in with coinsurance-maybe you pay 20%, and insurance pays 80%.

Your out-of-pocket maximum is the most you’ll pay in a year for covered care. Once you hit that number, your insurance pays 100% of everything else for the rest of the year. For 2026, the federal limit is $10,600 for an individual and $21,200 for a family. These numbers go up every year, adjusted for inflation.

The key difference? Deductibles come first. Out-of-pocket maximums come last. You pay your deductible before coinsurance starts. Then you keep paying coinsurance and copays until you hit your out-of-pocket maximum. After that? Free care for the rest of the year.

Do generic prescription copays count toward your deductible?

No. Not usually.

Generic drug copays-like the $10 you pay for metformin or lisinopril-are almost always not applied to your medical deductible. Even if you’ve paid $1,000 in prescription copays, your $2,000 medical deductible is still sitting at $2,000. You haven’t moved it.

This isn’t a trick. It’s how most plans are designed. Insurers separate medical costs from prescription costs. Why? Because they want you to pay for prescriptions upfront, even if you haven’t met your medical deductible. It’s a cost-control measure.

But here’s what does happen: every $10 you pay for a generic prescription does count toward your out-of-pocket maximum. So if your out-of-pocket max is $8,500, those $10 copays add up. You might not be getting closer to your deductible, but you are getting closer to the point where your insurance pays for everything.

Why does this confusion exist?

Because the system is messy.

Before 2014, copays didn’t count toward anything. You paid them, and they vanished. If you had diabetes and paid $15 for insulin every month, those payments didn’t help you reach your deductible or your out-of-pocket max. You were stuck paying forever.

The Affordable Care Act changed that. It said: all cost-sharing-copays, coinsurance, and deductibles-must count toward the out-of-pocket maximum. That was a huge win for people with chronic conditions. But it didn’t force plans to make copays count toward deductibles. So now you’ve got a two-track system:

- Track 1: Deductible (medical services only, usually)

- Track 2: Out-of-pocket maximum (everything: deductibles, copays, coinsurance)

That’s why people like ‘MedicareMom’ on HealthCare.gov were shocked. She paid $2,500 in copays thinking she’d met her $2,000 deductible. She hadn’t. She was only halfway to her out-of-pocket max.

What about plans with separate prescription deductibles?

Some plans have two deductibles: one for medical care, one for prescriptions.

In these plans:

- You pay full price for prescriptions until you hit the prescription deductible (say, $500).

- After that, you pay a $10 copay.

- That $10 copay counts toward your out-of-pocket maximum, but not your medical deductible.

So you could hit your $500 prescription deductible, pay $10 copays for months, and still owe $2,000 on your medical deductible. You’re not getting closer to it. And you won’t be until you actually see a doctor or get a test.

According to the Kaiser Family Foundation, 37% of employer plans use this two-deductible model. That’s more than one in three. If your plan has a separate prescription deductible, your copays only count toward that one-not the medical one.

What if your plan has a single deductible?

Some plans (about 27%) combine medical and prescription costs into one deductible.

In these plans, you pay for everything-doctor visits, labs, and prescriptions-until you hit the single deductible. After that, you pay coinsurance for prescriptions instead of a flat copay. So if your deductible is $1,500, you might pay $120 for a 30-day supply of your medication. That $120 counts toward your $1,500. Once you hit it, your copay drops to $10 or $20.

These plans are simpler. But they’re less common. And they’re often more expensive upfront because the deductible is higher.

How do you know which one you have?

You don’t guess. You check.

Every health plan must give you a Summary of Benefits and Coverage (SBC). It’s a 2-4 page document. Look for the section titled ‘How Your Costs Work’ or ‘Cost-Sharing’.

There should be a table. One column says ‘Does this count toward your deductible?’ For generic prescriptions, it will say No-unless you’re on a single-deductible plan. Then it will say Yes.

Also check your Explanation of Coverage. That’s the full document your insurer sends before enrollment. It spells out every rule. If you’re unsure, call your insurer. Ask: ‘Do my generic prescription copays count toward my medical deductible?’ If they hesitate, they’re probably not sure themselves.

What happens when you hit your out-of-pocket maximum?

Here’s the payoff.

Once you’ve paid $10,600 (for 2026) in deductible payments, coinsurance, and copays combined, your insurance pays 100% of all covered services for the rest of the year. That includes your $10 copays. They stop. You don’t pay anything else.

That’s why people with chronic conditions love the out-of-pocket maximum. ‘DiabetesWarrior’ on PatientsLikeMe reached their $8,500 max last year. After that, their insulin was free. No more copays. No more stress. Just medication.

That’s the whole point of the ACA rule: protect people from financial ruin.

What’s changing in 2025 and beyond?

The government is trying to fix the confusion.

In April 2024, the Department of Health and Human Services mandated that insurers make it clearer how copays count. Starting with 2025 plans, your SBC must highlight whether prescription copays count toward your deductible.

Some insurers are testing new models. In five states, a pilot program called the Integrated Deductible lets prescription copays count toward one combined deductible. Early results show 28% more people take their meds on time.

McKinsey predicts that by 2027, 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because people are fed up with the complexity.

But there’s a trade-off. Simpler plans often mean higher premiums. The American Hospital Association warns that removing the deductible/copay split could raise premiums by 3-5% each year.

So the future isn’t clear. But the rules today are: generic copays count toward your out-of-pocket maximum, not your deductible-unless your plan says otherwise.

What should you do now?

Don’t assume. Don’t guess. Don’t rely on memory.

- Find your SBC. Open it. Look at the cost-sharing table.

- Write down your deductible. Write down your out-of-pocket maximum.

- Track your copays. Add them up. See how close you are to your max.

- If you’re on chronic meds, calculate how many copays it’ll take to hit your max. That’s your freedom date.

Most people don’t know they’re paying $120 a year for meds that don’t move their deductible. But they do move them closer to being free. That’s the hidden win.

Know your plan. Track your spending. And remember: every copay you pay is a step toward not paying anything at all next year.

Do generic prescription copays count toward my deductible?

No, generic prescription copays typically do not count toward your medical deductible. They are treated as separate from your deductible and are designed to be paid upfront, even before you meet your deductible. However, these copays do count toward your out-of-pocket maximum, which is the total amount you’ll pay in a year before your insurance covers 100% of costs.

Do copays count toward my out-of-pocket maximum?

Yes, all in-network copays-including those for generic prescriptions-count toward your out-of-pocket maximum. This has been required by the Affordable Care Act since 2014. Once you reach your annual out-of-pocket maximum, your insurance pays 100% of covered services for the rest of the year, regardless of how much you’ve paid in copays or coinsurance.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay for covered services before your insurance starts paying a share (like coinsurance). Your out-of-pocket maximum is the total you’ll pay in a year for all covered services-including your deductible, copays, and coinsurance. Once you hit the out-of-pocket maximum, your insurance pays 100% for the rest of the year. The deductible comes first; the out-of-pocket maximum is the final limit.

Can I reach my deductible by paying only prescription copays?

Only if your plan has a single deductible that combines medical and prescription costs. Most plans (about 73%) separate them. In those cases, prescription copays don’t move your medical deductible. You’ll need to pay for doctor visits, labs, or hospital stays to meet your medical deductible. Check your Summary of Benefits and Coverage to confirm your plan’s structure.

How do I find out how my plan works?

Look at your plan’s Summary of Benefits and Coverage (SBC). It’s a standardized document your insurer must provide. Find the section labeled ‘Cost-Sharing’ or ‘How Your Costs Work.’ Look for the column that asks, ‘Does this count toward your deductible?’ If it says ‘No’ for prescriptions, then your copays don’t count toward your deductible. They still count toward your out-of-pocket maximum. If you’re unsure, call your insurer and ask directly.

Mike Rose

January 29, 2026 AT 23:35Adarsh Uttral

January 31, 2026 AT 18:55April Allen

February 1, 2026 AT 15:02Sheila Garfield

February 3, 2026 AT 05:09